We have loan officers in your community that thrive on helping you find the right mortgage to fit your needs.

Explore various loan program options for fixed and adjustable rate mortgages.

Our mortgage calculators help you hone in on your future mortgage based on options, interest rates, and more.

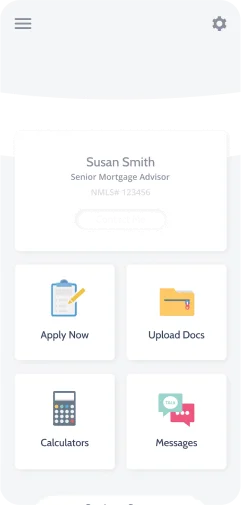

Get started with our secure application. It's a few quick questions that take about 12 minutes to complete.

We know that each customer has specific needs, so we strive to meet those specific needs with a wide array of products, investment tools, mortgages and best of all quality service and individual attention.

Today's technology is providing a more productive environment to work in. For example, through our website you can submit a complete on-line, secure loan application or pre-qualify for a home loan. You may also evaluate your different financing options by using our interactive calculators and going over various mortgage scenarios.

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

136-20 38th Ave, Suite 11i

Flushing, NY 11354

Phone: (877) 282-6561

info@smb-mortgage.com